Friday, December 21, 2007

Re: Sweet sorghum, non-edible oils need research

About 12 million hectares, or around 1 per cent of the world’s fields, are currently devoted to growing biofuels. Sugar cane and maize, for example, are turned into bioethanol, a substitute for gasoline, while rapeseed and palm oil are made into biodiesel. That figure will grow because oil is so costly, and because biofuels supposedly emit fewer greenhouse gases than fossil fuels.

But a slew of new studies question the logic behind expanding biofuel production. For a start, there may not be enough land to grow the crops on or water to irrigate them, given other demands on global agriculture. Worse, any cuts in carbon dioxide emissions gained by burning less fossil fuels may be wiped out by increased emissions of the greenhouse gas nitrous oxide from fertilisers used on biofuel crops.

In parts of the world, shortage of water is already putting a brake on agricultural productivity. According to Johan Rockström, executive director of the Stockholm Environment Institute in Sweden, switching 50 per cent of the fossil fuels that will be devoted to electricity generation and transport by 2050 to biofuels would use between 4000 and 12,000 extra cubic kilometres of water per year. To put that in perspective, the total annual flow down the world’s rivers is about 14,000 km3.

A more modest target of quadrupling world biofuel production to 140 billion litres a year by 2030 - enough to replace 7.5 per cent of current gasoline use, would require an extra 180 km3 of water to be extracted from rivers and underground reserves, calculates Charlotte de Fraiture at the International Water Management Institute, based near Columbo in Sri Lanka.

That target may be manageable across much of the globe. But in China and India, where water is in short supply and most crops require artificial irrigation, de Fraiture argues that there is not enough water even to meet existing government plans to expand biofuel production.

Another contentious issue is how much land is available to grow biofuels (New Scientist, 25 September 2006, p 36). And the answer appears to be not much, a point that Sten Nilsson, deputy director of the International Institute for Applied Systems Analysis in Laxenburg, Austria, makes using a “cartographic strip-tease” based on a new global mapping study.

Beginning with a world map showing land not yet built upon or cultivated, Nilsson progressively strips forests, deserts and other non-vegetated areas, mountains, protected areas, land with an unsuitable climate, and pastures needed for grazing (see Maps). That leaves just 250 to 300 million hectares for growing biofuels, an area about the size of Argentina.

Even using a future generation of biofuel crops - woody plants with large amounts of cellulose that enable more biomass to be converted to fuel - Nilsson calculates that it will take 290 million hectares to meet a tenth of the world’s projected energy demands in 2030. But another 200 million hectares will be needed by then to feed an extra 2 to 3 billion people, with a further 25 million hectares absorbed by expanding timber and pulp industries.

So if biofuels expand as much as Nilsson anticipates, there will be no choice but to impinge upon land needed for growing food, or to destroy forests and other pristine areas like peat bogs. That would release carbon now stashed away in forests and peat soils (New Scientist, 1 December, p 50), turning biofuels into a major contributor to global warming

De Fraiture is more optimistic. Her modest projection for a quadrupling of biofuel production assumes that maize production will be boosted by 20 per cent, sugar cane by 25 per cent and oil crops for biodiesel by 80 per cent. Assuming future improvements in crop yields, de Fraiture estimates that this might be done on just 30 million hectares of land - or 2.5 times the area now under cultivation.

Even today’s biofuel yields depend on generous applications of nitrogen-containing fertiliser. That contributes to global warming, as some of the added nitrogen gets converted into nitrous oxide, which is a potent greenhouse gas. Over 100 years it creates 300 times the warming effect of CO2, molecule for molecule. And now researchers led by Paul Crutzen of the Max Planck Institute for Chemistry in Mainz, Germany, who won a share of a Nobel prize for his work on the destruction of the ozone layer, claim that we have underestimated these emissions. Factor in their revised figures, and cuts in CO2 emissions as a result of replacing fossil fuels may be wiped out altogether.

“Fertilisers contribute to global warming, as some of the added nitrogen gets converted into a potent greenhouse gas“

The Intergovernmental Panel on Climate Change suggests that between 1 and 2 per cent of nitrogen added to fields gets converted to nitrous oxide, based on direct measurements of emissions from fertilised soils. But nitrogen from fertiliser also gets into water and moves around the environment, continuing to emit nitrous oxide as it goes. To estimate these “indirect” emissions, Crutzen and his colleagues calculated how much nitrogen has built up in the atmosphere since pre-industrial times, and estimated how much of this could be attributed to the use of fertilisers.

This suggested that between 3 and 5 per cent of the nitrogen added to the soil in fertilisers ends up in the atmosphere as nitrous oxide. Crucially, that would be enough to negate cuts in CO2 emissions made by replacing fossil fuels. Biodiesel from rapeseed came off worse - the warming caused by nitrous oxide emissions being 1 to 1.7 times as much as the cooling caused by replacing fossil fuels. For maize bioethanol, the range was 0.9 to 1.5. Only bioethanol from sugar cane came out with a net cooling effect, its nitrous oxide emissions causing between 0.5 and 0.9 times as much warming as the cooling due to fossil fuel replacement.

These simple calculations, which set increased nitrous oxide emissions against reductions in CO2 emissions caused by replacing gasoline or diesel with biofuels, do not account for all the greenhouse gas emissions associated with producing, processing and distributing the various fuels. Now Michael Wang of the Argonne National Laboratory in Illinois has taken Crutzen’s upper estimate for nitrous oxide emissions and plugged it into a sophisticated computer model which does just that. When he did so, bioethanol from maize went from giving about a 20 per cent cut in greenhouse gas emissions, compared to gasoline, to providing no advantage at all. Still, Wang suspects that Crutzen’s method may overestimate nitrous oxide emissions. “It is a very interesting approach,” he says. “But there may be systematic biases.”

Crutzen stresses that his paper is still being revised in response to comments he has received since August, when a preliminary version appeared online. “Here and there the numbers may change. But the principle doesn’t,” he says. “It’s really telling us about a general problem with our lack of knowledge about the nitrogen cycle.”

With governments and businesses backing biofuels as part of a “green” future, that represents a disturbing gap in our knowledge.

Sunday, November 25, 2007

Near space

I've become interested in launching my own near space project lately. Near space satellites use helium-filled weather balloons to send a small payload up to 30 km. Usually this payload includes a camera and a gps tracking system connected to a cellular modem of some kind. After parachuting back to the surface the phone contacts you and you go pick up the camera.

Here's a picture from a near space satellite a guy built for just $600:

It could be possible to use such a platform for a high-powered rocket, to send a satellite above the 200 km border that marks the beginning of space and the first altitude at which a satellite's orbit can be maintained against atmospheric drag.

How much do you think I could charge to put people's ashes into space?

Thursday, September 6, 2007

Trouble on Private Space

July 27, 2007

Three people were killed and another three seriously injured in a blast at Mojave Spaceport, located in California, United States. The blast occurred on Thursday at 2:34 p.m. PDT (UTC-7) while Scaled Composites was conducting cold flow test of a rocket engine.

According to Tony Diffenbaugh of the Kern County Fire Department, two of the victims died immediately in the blast, while the third succumbed to his injuries at the hospital.

"Our units arrived on the scene at a remote test site in the northeast portion of the airport. What they found was six victims of an apparent explosion with various traumatic and burn injuries," Diffenbaugh said.

Burt Rutan, founder of Scaled Composites, said a press conference: "We just don't know" why the explosion occurred, nitrous oxide usually is "not considered a hazardous material."

Scaled Composites is in a partnership with Richard Branson's Virgin Galactic to build SpaceShipTwo, which hopes to become the first commercially available passenger spaceflight for space tourism.

The accident comes just days after Northrop Grumman announced it would increase its stake in Scaled Composites to 100%.

>> Elon Musks's SpaceX project aims to put objects in orbit with more standard liquid oxygen rockets, much more difficult than the 100 sub-orbit that defines 'space'. Unfortunately its second flight failed to reach orbit because of control issues:

Second test flight of Falcon 1

The second Falcon 1 launched a demonstration payload to return data on the booster's performance, however it failed to reach orbit. The second stage was shut down about a minute and a half before schedule (T+ 7:30) due to a control issue. [4] SpaceX later stated that "The second stage was otherwise functioning well and even deployed the satellite mass simulator ring at the end of flight! Actual final velocity was 5.1 km/s or 11,000 mph, whereas 7.5 km/s or 17,000 mph is needed for orbit."

The first launch attempt was targeted for 2300 UTC, 20 March 2007 however it was aborted one minute and two seconds prior to launch (T minus 00:01:02) due to a ground control software handover failure. A second attempt was made at 00:05 UTC, 21 March 2007, but the launch was aborted automatically 0.5 seconds after firing the engines because the main engine chamber pressure was about 0.2 percent lower than allowable. The low pressure was caused by the fuel being colder than desired. The third attempt successfully launched the rocket at 01:10 UTC, 21 March 2007 (13:10 local time, 20 March 2007), the vehicle separated from the first stage booster and fairing at approximately 6:14 PST.

The webcast from the vehicle was lost at T+ 5:05 at an altitude of approximately 300 kilometers, but SpaceX was able to retrieve telemetry for the entire mission. The video showed a coning motion that increased during the second stage burn, then a roll immediately before loss of signal.[5] Musk noted that the control problem was initiated during stage separation, when the shut down kick of the main engine exceeded their predictions. This caused a bump between the first stage and second stage engine nozzle, along with sloshing in the tanks. The vehicle's systems were designed to damp out sloshing, but the unexpected motion exceeded design parameters. [4]

SpaceX stated they were happy with the launch as the rocket reached space and validated the riskiest and most difficult parts of the new design. Musk expressed confidence that they would solve the control issue and noted that all new rockets typically have these problems to work out; "I think they had something like 12 Atlas failures before the 13th one was success. To get this far on our second launch being an all-new rocket -- new main engine, new first stage, new second stage engine, new second stage, new fairing, new launch pad system, with so many new things -- to have gotten this far is great." [6] A post-mission report declared this launch "the end of the test phase for Falcon 1 and the beginning of the operational phase." [7]

>>> Finally, it appears that early estimates that carbon nanotubes (a form of carbon stronger than diamond) are a candidate material for building a skyhook (see here) were overly optimistic. First, because the measured tensile strength of real nanotubes are about half of their theoretical limit; and second, because the impurities which cause this weakness are more or less inevitable.

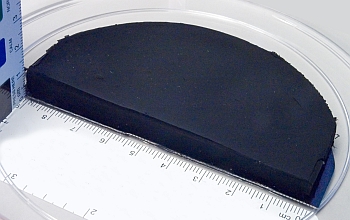

In this paper various deterministic and statistical models, based on new quantized theories proposed by the author, are presented for estimating the strength of a real, and thus defective, space elevator cable. The cable, ~100 000 km in length, is composed of carbon nanotubes, ~100 nm long: thus, its design involves nanomechanics and megamechanics. The predicted strengths are extensively compared with the experimental and atomistic simulation results for carbon nanotubes available in the literature. All these approaches unequivocally suggest that the megacable strength will be reduced by a factor at least of ~70% with respect to the theoretical nanotube strength, today (erroneously) assumed in the cable design. The reason is the unavoidable presence of defects in so huge a cable. Preliminary in-silicon tensile experiments confirm the same finding. The deduced strength reduction is sufficient to place in doubt the effective realization of the space elevator, that if built as designed today will certainly break (in the author's opinion). The mechanics of the cable is also revised and possible damage sources discussed.>> For all that, the mass production of long nanotubes has grown by leaps and bounds and now exceeds the length extimated here by a factor of several million:

|

The carbon nanotubes grew atop a specially designed wafer catalyst that allowed growth to continue for a relatively long duration. The individual fibers are difficult to discern in this image but appear as striations when they catch the light. |

Flipping properties with a nod to Mother Earth at Second Nature Homes

By Jennifer Garrett

|

When Darin Harris and Dawn McCluskey spot a ramshackle ranch in a nice neighborhood, they immediately start to see green. But this remodeling duo has more than dollar signs in their eyes. This pair of tree huggers has launched a business so that they can turn a profit while treading lightly on the environment.

Like hordes of other part-time real estate investors, this husband-wife team has bought and rehabbed several houses, usually while living in them as they fixed them up. Each time they made a profit, even when they used contractors for much of the work. More importantly to them, though, is that they made money even when they bypassed standard materials and processes in favor of eco-friendly choices.

That got them thinking. They could use real estate to generate income without clouding their collective conscience. So Harris, a consultant at UW--Madison, and McCluskey, a veterinarian, concocted Second Nature Homes. They would buy rough-around-the-edges houses in neighborhoods with good appreciation potential, renovate the homes and then sell them for a profit -- all without living in a construction site, without giving up their day jobs and without compromising their environmental principles.

"We're sort of green flippers," Harris says, referring to the real estate term for buying, fixing up and selling houses relatively quickly. "We're not doing this just for the money. Your home uses more resources than any other part of your life … so we're out to save resources, including energy, and improve health."

Right now they are rehabbing a three-bedroom ranch in Nakoma. They've replaced the furnace, gutted the bathroom, exposed part of the basement so they could turn it into an additional bedroom, and otherwise upgraded and updated everything. All the while they use low-emission paints, formaldehyde-free insulation and Energy-Star-certified appliances and materials.

Harris says all of Second Nature Homes' projects will meet or exceed requirements for Wisconsin Green Built Home certification, a voluntary program that sets standards for sustainable building practices and energy efficiency.

While Green Built Home has had guidelines for new home construction since 1999, the organization implemented its remodeling program just last year. Nathan Engstrom, program director for Green Built Home, says Second Nature Homes is not only the first Wisconsin company enrolled in the program, but it is also the only remodeling business expressly founded on the principles of green building. "It wasn't an afterthought or an add-on," Engstrom says. "From the very beginning, from the ground up, they have built their business on these concepts."

Harris and McCluskey know that green isn't the only way to go, but they think it's the best one. And they think other homeowners and investors would agree if they knew more about it and had some proof that environmentally friendly renovations could also make money. "We hope to set a standard," Harris says. "We're going to spend a little more money remodeling this house than they average remodeler would, but we will sell it at market rate. It sounds a little too good to be true, but we did a really good job negotiating the price on the front-end."

For the time being, Second Nature Homes will continue as a part-time venture, but McCluskey and Harris plan to keep at it as long as they continue earning a solid return on their investment. "I really like my work, so there are no plans to take this full time," Harris says. "We'll just take it one house at a time and see how it goes."

Thursday, August 23, 2007

Woz on flipping green houses

ECN: Steve, thanks very much for your time. Here are nine questions for you, based on the PC World blurb. How and when did you become interested in energy-efficient construction? Do you have any plans to use your house as model for encouraging other people and companies to design their buildings more cleanly?

Woz: I am looking for sites but haven't had enough time to narrow one down yet. I'm mostly interested in areas of the California coast, like Half Moon Bay or San Luis Obispo. ... I have always had an interest in my own self-sacrifice to help the environment. I gave much money to groups working for forests and rivers. But I was probably misguided. I have no idea how effectively my money was spent or if it helped save one more tree or patch of river for future generations. Still, most of our charitable giving is in the sense of feeling that we are in some category we want to be in.

The term "energy efficient" is rather vague. At some level it implies some form of conservation. I have great reservations with that concept as well. One aspect of conservation is to use less so that there is more to go around, either to more people or for a longer time. I disagree with this concept pretty strongly. Personally I want to conserve but I wouldn't push that concept on others as a "right" way to live. I only want to serve as an example. I don't want to tell others that they are bad people or doing "wrong" things. That's not a good way to keep open communication. I also have trouble with the concept that we can have more of a "worse" life. It's a conflict between quality and quantity and life should be judged by quality.

The form of energy efficiency that appeals greatly to me is the idea of efficiency of construction. I have always admired getting the same results with fewer parts or procedures. That's a win for everyone. I used that concept in my design approach in life. I was determined to give my highest regard to engineers and in engineering we always strive for more efficiency, defined mathematically as more out for less in. If you can build a car at the same price, with the same features (size and performance) yet it uses less gasoline or pollutes less, that's a win for everyone, including the car manufacturer. Engineering leads to such advances, even when they seem like tiny steps.

Now, let's get to your point of energy efficient homes (or other facilities). I see two main parts to this issue. The first is using techniques to build homes with the least energy usage (and the least pollution). For example, ram-dirt is a material made of the dirt dug under where your home will be. It uses less energy than any other building material form to create, with a machine right at the construction site. Saving energy is good also in the sense that the energy to make this material usually comes from burning coal and emitting pollutants into our air. When properly applied, this form of construction is very low cost but applicable to luxury homes. I have spoken to builders who build luxury homes out of this material and have friends who are starting a company to manufacture blocks of this material for delivery to the site when the ram-dirt method cannot be used due to soil properties. This material is manufactured with grooved shapes and nails are not used in the construction. A home made of this should last 500 years, not just 75 years.

The other form of energy efficiency in homes is in how much energy your home uses to operate. We emit more pollutants such as carbon dioxide in our homes than in our cars. That includes the coal burned to provide our electricity, but there are other reasons that homes are responsible for such emissions. If you can build a home, with the same effort and cost, that uses less electricity, it's a win for everyone and any engineer can gloat.

Recently I was a judge at a History Channel Modern Marvels Invent Now Challenge in association with the Inventors Hall of Fame. A few of us judges were really taken by the winning entry and I suspect that more than myself are moving toward building the sort of home that won.

You build a home out of a type of wood that keeps the temperature constant without air conditioning or heaters. The miracle wood in this category is Southern Yellow Pine. As for renewable resources, more Southern Yellow Pine trees are planted each year than are used. I'm told this is the only tree with this benefit. The Southern Yellow Pine has a resin inside that melts and freezes at 71 degrees F., a very comfortable temperature for humans. The chemical actions of melting and freezing work to balance the temperature. If it's a hot day, some small amount of the resin melts (it takes a huge amount of energy to melt a tiny amount) and the melting process pulls heat from the surroundings, from the home. When it gets colder at night, the resin-wood emits heat as it freezes.

In high school chemistry we had the latent heat of fusion concept. You let ice settle in water. You can measure the temperatures. The ice and water are both 32 degrees F. It seems like the tiniest amount of energy would cause the ice to melt. After all, you only have to change it maybe a hundredth or less of a degree. But it takes a huge amount of energy to accomplish melting. This represents the difference in energy between the solid and liquid states. In this way, large amounts of energy can be stored. In the case of Southern Yellow Pine, energy from the summer can even be stored in the wood until a later season in some cases.

This company Enertia prepares blocks of this Southern Yellow Pine with grooves and sells the pieces as kit homes that you build yourself. The only tool you need is a power drill. No nails are used in the construction. I suspect that's because the metal of nails helps outside temperature conduct to the inside. The homes are also designed in an envelope fashion with 2 layers of wood and a space between them for natural air circulation around the home. The Southern side is all glass to collect sunlight. The homes are designed for more sunlight getting in during the Winter, when the sun is lower in the sky, than during summer, when the sun is higher in the sky.

All of these simple principles wind up with a very attractive house that is as normal and livable as any other, but without insulation or air conditioning or heating. The typical energy bill might be as low as $30 a month, depending on where you live. The outside temperature can be 50 degrees hotter or colder than the inside temperature of 71 degrees.

Recently I bumped into the builder of my first home. We reminisced and I told him of my plans to build one of these Enertia homes. He had built many homes with the efficient ram-dirt process and for one of them he used the resin-wood (presumably Southern Yellow Pine) for the roof. With only the roof being of this resin-wood the temperature inside never varied more than 5 degrees he told me. So the combination of approaches is one thing I'm considering too.

I like things simple with fewer parts and fewer added technologies. Just think out the right ways to build a home and do it. So few people know how easily all our homes could have been energy efficient rather than energy wasters. I suppose it's an outcome of the fact that energy is so cheap and abundant now. I think of it this way. The timeline of history and of man will be many millions of years long. Over that timeline, at some point man was going to find oil and ways to use it. Whenever in time that had happened, the generations it happened for would have used it up. We are those generations using it up, but if we saved it and didn't even touch it at all, some future generation would quickly use it up. The time that mankind has oil may be a short blip on the long timeline of humans. Whenever the discoveries were made, that blip would have appeared. We needn't think of ourselves as bad just because we were the lucky ones to have the oil blip.

ECN: Many experts say the clean-tech industry is today where the home computer industry was 30 years ago, where it's just a couple of companies and many amateurs. If true, what can the clean-tech industry learn from it?

Woz: No, it's not comparable to personal computers. Personal computers didn't have to tear down an infrastructure. Even if a few people like myself are building energy efficient homes (and a ton more are building things that are barely energy efficient or they are using one thing that's energy efficient in a very inefficient home that swamps the gains) we are moving out of our inefficient homes, selling them to someone else. So only new homes can be built this way. It will take many decades or centuries to replace the existing inefficient homes with efficient ones. The best you could do is to tear down an inefficient home and replace it with an efficient one. But few of us can afford to do that. It's normally done out of vanity instead - to build a home the way you want.

Eventually the word will get around and good examples will be noticed.

I do fear that big companies will build inefficient homes in other countries for the sake of making money. Those people will be stuck with homes that would cost a lot to air condition. If the right technologies were exported then they would have nice cool homes from the start. I don't know how to spread the word. Education in the world does a poor job in these areas and even when you have the education you are at the mercy of the sellers you encounter. The mass media does a poor job of educating in these areas also.

ECN: In PC World, you said, "It's like the way I used to make computers" -- how so? Also, are you hearing about any user groups for people who are building efficiency homes, a la the Homebrew Computer Club?

Woz: Simple design. Think about the right way to build something and take a lot of time to get it the best that can be done with the fewest resources used. No waste. Build it right and with few parts it does a lot. Don't cover things with more and more and more technology for features. Design them in from the start. It starts with the architect, of a home or a computer, working from a knowledge of the building materials and a desire to choose wisely.

ECN: Will you be using any other alternative energy sources, such as biofuels, solar cells, or wind power? Do you plan to sell any energy back to the local utility company?

Woz: I plan on a very low electricity bill that could justify solar cells. I worry that if it takes more energy to make and install a solar cell than it returns in its lifetime, then it's a loser. But you can't lose if it's a small addition to the home. I also may install AC/heating but hopefully never use it. I am deathly afraid of cold or hot homes but I'm willing to jump in the water and take my risks for something I believe in.

I may wind up buying some commercial solar cells with all the stuff to sell electricity back. But my electricity needs should be so small (clothes washer, lights, computers, TVs) that it may not amount to a significant amount.

ECN: Of the energy-saving techniques you will use, which are the most cost-effective or appeal to you the most? Are there any specific green technologies that you'd like to have today, but which aren't yet feasible?

Woz: I haven't analyzed if these Enertia Southern Yellow Pine woods are cost-effective. The total cost of the materials for a home seems reasonable to me but I'm not a builder. Once the home exists however, the energy savings and cost savings will come principally from the resin in the wood, but also from other carefully thought out aspects of the design. The designer is a civil engineering professor at BYU and cares a lot about saving the environment in every step of these homes, including how he makes the wood blocks for you.

ECN: Regarding the electronics that you anticipate using, do your concepts require any special advancements or new techniques? Or do you just plan to use existing systems in new ways?

Woz: I don't expect many changes. I want a large LCD TV and I use a laptop too. I buy energy efficent clothes washers and dryers at Sears too. As for house lights, I hope that LEDs make it further toward lighting normal homes by the time I build mine.

ECN: What are your plans for sharing the knowledge gained during the design, construction, and long-term living phases of this house? Maybe you could make a web page so others can learn from it.

Woz: Maybe. Not my first priority but it should be high. I expect accidental articles in papers and magazines featuring me because such happens a lot when reporters hear that I'm doing anything. [Editor's note: this article is a case in point!]

ECN: Do you envision the house as being just a cool hack that also helps the environment, or are you looking to invest in or even get personally involved with any startups for such technology?

Woz: Both. But I don't have a lot of investment money. I'm already on the advisory board for the ram-dirt startup I mentioned. It's called Integrity Block but is not off the ground yet.

ECN: What are you thoughts on balancing energy efficiency vs. overall environmental impact? Urethane-foam, for example, works well as an insulator but it takes oil and energy to produce and transport.

Woz: The total formula for saving energy can be quite deceptive. It's not correct to say that you are energy efficient when it's only in one way but your net is negative. For example, an electric car may use only half as much, or a third as much, energy as the same sized car using gasoline. But if it costs $100,000 then you realize that you wouldn't spend that much on gasoline over the life of any car. And even using the car uses some gasoline or coal used to create the electricity, to charge your batteries. If the car is inefficient in some ways it may even use more coal per mile but you'll be telling all your friends that it uses none. The cost of something is a reasonable estimate as to how many resources (of the Earth) you used to build the device. Don't take your instant opinion on energy efficient technologies to be correct. Ask a lot of deep questions and hold off until you are very sure

Wednesday, August 22, 2007

Hydrogen storage

old about why hydrogen doesn't work yet.

Remember that, to produce the hydrogen needed by America's cars via electrolysis (splitting water with electricity) requires 8,000 TWh---twice the current total electrical throughput.

Well, the other problem is storage. Hydrogen carries a lot of energy per unit volume, since it is so light. But I think you can take it as impossible that the half-million dollar systems being used to store liquid hydrogen in today's experimental cars will ever go to market. Here's the volumetric and weight densities of hydrogen as a gas or liquid, and absorbed into a metal hydride. When they say 'minimum performance goal', they mean it: without a good storage system, a hydrogen fuel cell is essentially an inefficient battery. Pack your car with kilos of metal and it won't get far; it won't sell.

The real alternatives are the solid metal hydrides, metals which hydrize at certain temperatures and pressures. Magnesium Hydride, Mg H_2, stores the largest density of hydrogen but requires >300 C to let go of it

Again of the reversible hydrides simple magnesium does best. Magnesium is the world's third most abundant metal. Iron titanium comes next for price. Pretty much everything else is an exotic designer alloy as of now: tens of thousands of dollars per kilo.

Again of the reversible hydrides simple magnesium does best. Magnesium is the world's third most abundant metal. Iron titanium comes next for price. Pretty much everything else is an exotic designer alloy as of now: tens of thousands of dollars per kilo.

Here you see the temperature at which the metal hydrides release the hydrogen at standard pressure. There's about a 30% penalty to heat the magnesium (30% of the fuel cell keeps the metal hot) but the same applies to liquid hydrogen. Plus you're driving the Hindenberg!

One possibility is alloying Lanthanum (a room temperature hydrilizer, but energetically poor) with the hot metal magnesium. But still---you look at the above graph and its basically a line, either you get density or temperature. It would nevertheless be possible to build a heat battery from Magnesium, and it sometimes wonder if it might beat big flywheels as energy storage.

We're building just massive flywheels at the moment to convet electricity into kinetic energy and back. They're run on superconducting bearings. But another time...

Tuesday, August 21, 2007

Democrats = Enviornmental R&D

Richard Simon, Washington

August 22, 2007

REFLECTING a shift in priorities under the Democratic majority, US Congress is moving to spend as much as $US6.7 billion ($A8.4 billion) next financial year to combat global warming, an increase of nearly one-third from this year.

House appropriations bills call for about $US2 billion in new spending on initiatives aimed at reducing greenhouse gas emissions and oil dependency, significantly expanding the budgets for new and existing research initiatives.

While legislation to raise car fuel efficiency standards and cap emissions from power plants has been slower-moving — because of resistance from some members of Congress — Democrats have turned to the budget to advance their environmental priorities by increasing spending on lower-profile programs.

But that will probably set up a showdown between Congress and President George Bush, who wants to spend less on climate change initiatives.

The White House budget office, which has complained about excessive spending in the overall appropriations bills, noted that Mr Bush's budget provided for a 3 per cent increase in spending for climate change activities.

Members of Congress from both parties also see the public's heightened interest in climate change and energy security as an opportunity to steer federal money to their states.

Money has been set aside for scores of home-state research initiatives and construction projects.

"Green is becoming very fashionable," said a Republican congressman from Ohio, David Hobson, who secured $US500,000 for a geothermal demonstration project at Ohio Wesleyan University.

"I think members are going to be challenged in their district," he said, referring to how they respond to concerns about climate change and US dependence on foreign oil.

Adam Schiff, a California Democrat, got $US500,000 for a fuel-cell project by Superprotonic, a Pasadena company started by California Institute of Technology scientists.

"America needs to wean itself off of foreign oil," Mr Schiff said in a statement. "This is as much a national security imperative as it is an environmental one. And federal support for innovative new technologies is part of the answer."

Some of the largest increases are in the bill that funds the Department of Energy.

The House provided about $US1.9 billion for energy efficiency and renewable energy programs, about 52 per cent more than the Administration requested.

Just two years ago, under the Republican-controlled Congress, the programs received about $US1.2 billion. The Senate has yet to complete its spending bills, but its appropriations committee has recommended about $US1.7 billion for energy efficiency and renewable energy programs.

Environmentalists welcome the increased spending but say more pollution regulation is crucial.

"Those spending measures are no substitute for better fuel economy standards and tough caps on greenhouse gas emissions," said Frank O'Donnell of Clean Air Watch.

Some of the projects are the result of unusual alliances between members looking out for home-state interests and those seeking to reduce pollution. Those in coal-producing areas have been among the strongest supporters of increased funding for projects to capture carbon dioxide from coal-fired power plants, seeing it as a way to preserve the coal industry.

Critics say some projects may be worthy, including energy research initiatives, but others are merely classic pork-barrel spending, particularly construction projects that have been touted to Congress as green.

Tuesday, August 7, 2007

Jatropha breeding

Breeding objectives

Breeding objectives will depend on use. Oil yield will, in most cases, be the most important

part of physic nut cultivation. Components that contribute to physic nut oil yield

per hectare are: number of pistillate flowers per inflorescence and subsequent number

of capsules per shrub, number of seeds per capsule, 1000-seed weight, oil content of

seeds (%) and plants per hectare. As the maximum number of seeds per capsule is

limited and the agronomic factor of planting density does not offer much flexibility for

increasing yields, selection should focus on the other yield components.

Ferrao and Ferrao (1984), and later Heller (1992), found highly significant correlations

in different seed samples between the 1000-seed weight and percent of crude fat

content. This might be interesting from the breeders’ point of view, as simple selection

for high 1000-seed weight could imply increased crude fat contents. From this, it cannot

be concluded that shrubs which produce seeds of a high 1000-seed weight, and consequently

a higher crude fat content, will yield more oil per hectare. A high 1000-seed

weight can also be the consequence of a low seed yield per shrub. Further research on

this is required.

Other important objectives are reduced plant height to facilitate harvesting of capsules

and development of non toxic cultivars, where the seed cake could be used as

fodder.

Monday, August 6, 2007

The figures for land contracts are either fake or revolutionary: even at a conservative 500 litres oil/hectare the 70,000 hectares contracted here would replace 70% of the UK's yearly oil consumption.

There are also a few 'hippy' projects, such as one run by the Himalayan Institute. Neodyne is an Indian company that's planning the growth of pongamia, particularly for the direct use of seed oils in diesel engines to promote village economies.

D1 doesn't look like a hippy project and it ain't aiming for villages. It looks like big business, the kind of entrepreneurship that high oil prices (and taxes, and an economy that has so disconnected itself from industry that it can grow independant of oil consumption) lead to.

Australia has a helluva lot of undeveloped land, used for low-density sheepherding because there's no water. A lot of farms were started in the early 1900s as the aussies pushed into the center of the country, which failed to be viable.

But, are there any crops that would be happy to grow on dry land, be resistant to drought, and would provide a biofuel? The key here is that Australia is in a unique position of being a first-world nation, with quick development times, but is located on terrible and valueless soil.

Answer?

RESEARCH INTO THE PRODUCTION OF BIO-DIESEL FROM PERENNIALS

A scoping study funded through South West Catchment Council (SWCC)/NationalAction Plan (NAP) into the development of industries for saline land, identified threeplant species suitable and potentially economically feasible for this environment. Themain product of two of these plant species, is the production of bio-diesel. Thementioned plant species are Moringa oleifera and Pongamia pinnata. Both are tolerant to high salinity levels, waterlogging, frost and drought. Their pods are harvested, meaning that the trees keep on growing, using water and reducing the high watertable whilst sequestrating carbon.

Bio-fuels must be sustainably, with these two plant species fitting all the criteria.

It is salt tolerant:Land salinasation is one of the greatest challenges to landproductivity and water resource management in the SW Agricultural region withdryland salinity affecting 30 per cent of the SW Agricultural Region in WesternAustralia (1 million hectares) or at risk of being affected in the future.

It can grow on marginal land: Traditional cropping of marginal land combined withcontinuous rising input costs is not economically viable. Land has to be farmedaccording to its capacity.

It sequester carbon and reduce greenhouse gasses: Climate change and greenhousegas emissions are becoming more important by the day. Addressing these issues aspart of every farming system is crucial, not only for the environment but also formarket access and premium prices.

It is an ethical land use: Utilising crops suitable for human consumption or landtraditionally producing grain for bio-fuel production is contentious, however thesetrees can be grown on marginal land. Supply and demand factors and energy balancemake other bio-fuels less of an option but the energy balance is positive for thesetrees and it does not compete with traditional food for human consumpton.Although the ideal climatic conditions for these plants are dry-temperate, they do grow in Mediterranean climates with not much known about yields in this environment. Because none of these plants is grown on a commercial scale in Australia, international data on yields was used for an analysis, which produced promising results in terms of profitability. These data suggests that:

Pongamia pinnata produce 2,000 – 4,000 litre bio-diesel per ha per year.Production starts from year 4 onwards. The oilcake is used for fertiliser andcontains a natural insecticide. Water requirements under rain-fed conditions are500mm plus and internal rate of return calculated at 47 per cent (non-irrigated).

Moringa oleifera produce 1,000 to 2,000 litres bio-diesel per ha year. Productionstarts within a year and the oil cake and leaves are excellent stock feed. Minimumwater requirements under rain-fed start at 250mm whilst the internal rate of returnwas calculated at 84 per cent (non-irrigated).

>>>>1000 litres per hectare is astounding. For comparison:

Here in Australia, ethanol is being produced from sorghum (a relative to maize, which can be harvested multiple times during the year and requires only 1/3rd the water of sugarcane) and a 2% mixture (E2) with gasoline is being mandated in New South Wales, where the largest plants are located.

The Howard gov't has recently guaranteed that biofuels will be untaxed until 2011, with a slow ramp-up afterward. However, the Howard gov't refuses to mandate E10 usage countrywide. Australia plans to produce 350 ML of biofuels by 2010 (10% of the fuel needed for a full gas-to-E10 conversion).

Ethanol use in a gasoline mix, or in a 'flex-fuel' engine designed to handle either gas or pure ethanol, reduces the amount of greenhouse gas emissions only slightly, while it increases the amount of smog-producing nitrous oxides. It must compete not only with the price of oil but the exchange rate with the US (remember, OPEC only accepts dollars). In order for ethanol to be cheaper than gas oil must be at $65/barrel and the aussie dollar at <$0.65 (US). Today it's $73 and $0.85. Also, there is some controversy that more energy is used to produce a liter of ethanol with grain-stock than is contained in the ethanol (the estimate is now around 120% but this has a lot of fudge factors, see below)

FeedstockEnergy output/fossil energy inputSugarcane8.3Sugar Beet (European Union)1.9Maize (United States)1.3-1.8Wheat (Canada)1.20Switch grass4.4Fossil fuel (Gasoline)0.8Sweet sorghum (Hosein Shapouri, USDA)8.0 (12-16 in temperate areas)

Local ethanol production does inject money into the Australian economy. A speculative boom in the price of raw sugar in mid-2006 was brought about by the addition of an ethanol market, and prices for land in wheat- and corn- producing states has grown on the back of green speculation.

Australia’s first ethanol plant begins site preparation

Bulldozers started preparing road access and a railroad crossing in December at Australia’s long-awaited ethanol plant near Dalby, Queensland. Dirt work was expected to start in late January with mechanical construction starting shortly thereafter, according to Chris Harrison, director of Dalby Bio-Refinery Ltd. Harrison, who has more than 25 years experience as an independent fuel and lubricant distributor, has championed the Dalby project since 2002. Initially scheduled for construction in 2003, two issues delayed the project. “Excise has been resolved, with a zero excise until 2011 and then a phase-in of 2.5 cents per liter (cpl) until 2015 when the final excise applicable to ethanol of 12.5 cpl will apply,” Harrison said. The project also had to fight for support from Australia’s major oil companies and consumers. Dalby Bio-Refinery won the fight with “time and perseverance,” according to Harrison. “The major oil companies in Australia are now demonstrating a commitment to achieving the federal government biofuel target by 2010, and consumer confidence is improving daily,” he said. The US$75 million ethanol plant will employ 30 people and produce 80 mmly of ethanol (21 MMgy) from sorghum. It will also produce around 170,000 tons of distillers dried grains with solubles. Delta-T provided the plant design, and Leighton Construction is handling the construction.

Environment trend has green cash potential

Note: Real estate expert Ozzie Jurock is to be a speaker for the real estate section of the InvestFest conference, which is to be held on June 8 to 11 at the Fairmont Palliser Hotel in Calgary.

"According to a new U.N. report, the global warming outlook is much worse than originally predicted. Which is pretty bad when they originally predicted it would destroy the planet." Jay Leno

Green. The term is everywhere these days.

Climate change and global warming have become the new doomsday clock, the new cold war, the new Y2K of our collective what-if nightmares.

Attempts to inject rational thought into the zealous belief that human activity will cause seas to rise, crops to fail and hurricanes to whirl is being drowned out in an amazingly on-script media and public chorus.

Yet, according to the Intergovernmental Panel on Climate Change, the international august body which recently released its definitive report, if the entire world accepted the complete Kyoto protocol (which commits to reduce carbon emissions by five per cent from 1990 levels by 2012) tomorrow, there would be no noticeable change in the planet's climate for 80 years -- at a cost of five Iraq wars per year.

To put it another way, if Canada immediately stopped producing any form of greenhouse gas emissions, it would take only 18 months for that to be replaced by China's growth in emissions.

Sorry, your new Hybrid will not make much of a difference in the big global picture.

We agree with the premise behind climate change, but we also agree with the findings of the experts that nothing we do in our lifetime in Canada will make any difference, and it is not likely it will change the weather for our children, or even our grandchildren.

It reminds me again of the old adage: "Forecasting is never easy, particularly when it is about the future."

But the American government currently spends 51 cents US per gallon to oil companies to produce ethanol, plus a thousand other incentives and that lead us to believe that we should be buying farmland in Saskatchewan, for example.

The U.S. government also gives some $6.5 billion in grants to the "green research" industry.

All that momentum -- valid or not -- will accelerate the train towards more greening. Most importantly, the reality is that the Canadian public, especially in B.C. and Alberta, are solidly behind the climate change philosophy and most (at least 80 per cent according to a recent poll) want to personally do something about it.

With that kind of support, green is a force to be reckoned with in the real estate industry and it would be a fool who would ignore the challenges and opportunities it represents (certainly -- we hasten to add -- in my own home, we recycle religiously, eat organic, use biodegradable cleaners and soaps, and we look continuously for ways to be become more and more aware.)

The green real estate effect is already having an impact on everything from house sales to farmland, from condominiums to waterfront.

We have seen some very interesting real estate reactions to the green philosophy, some of which were overdue and make good economic sense.

Consider Avalon Homes of Red Deer.

Five years ago, as a newcomer to the booming Alberta new home market, Avalon was struggling to make its first sales and find a niche in the competitive market.

Then it began marketing itself as the "green builder," constructing homes that are a notch above others in Alberta's popular Built Green program founded in Calgary.

Today, Avalon is among a dozen builders across Canada -- and three in Alberta -- chosen by the federal government this February as the top environmentally conscious in the country.

Last year, Avalon sold 200 new houses, making it the number one builder in Red Deer despite charging more than its competitors.

It expects to top that sales pace this year. Its prototype house has solar panels on the roof, thick insulation and other green attributes that make it a "zero net energy" house, meaning it can actually produce as much energy as it uses.

Chard Developments in Victoria is another example.

In the midst of a slowing new condo market in Victoria, which saw 3,100 new condos started last year alone, Chard presented a "green twist."

In its pre-sales for its 15-storey Juliet tower now being built on Johnson Street, Chard offered to cut $25,000 off the price if the buyers would forego an underground parking space for a bicycle locker and a deal to join in a local car share program, where Chard would pay their initial membership fee.

It worked. The lower cost suites -- in a building with an average per-square-foot price of $500 -- sold first and fastest, the project received positive press as a green project and Chard could spend less on the parking space.

In Vancouver, developer Aragon Properties Ltd. is marketing a townhouse project that it built on spec on a former industrial site in one of the less-than desirable neighbourhoods of Marpole.

But, by an intelligent blend of fairly low-cost green features, its Moda project has proved a hit with the upscale, yuppie clients it was aimed at.

The green attributes include recycled brick for interior walls, reclaimed wood for the hardwood floors and individual gas meters allowing residents to monitor and control individual gas use, plus Energy Star washers and dryers.

Not a lot of green, really, but enough to notch Moda successfully into the "green marketing" environment.

Of course, the green marketing can stretch credulity a bit.

In Ucluelet, where legendary golfer Jack Nicklaus is backing the new Wyndansea Oceanfront Golf Resort, developers have recruited the Audubon Society, a non-profit environmental organization, as overseers on the project.

The entire project, which will cover hundreds of hectares along the Pacific Coast, will also be built to the Leadership in Energy and Environmental Design (LEED) Gold standards.

It turns out, incidentally, that the Audubon Society is overseeing 27,600 hectares of "sustainable" golf courses around the world (only a cynic would question that if the developers are so concerned with the environment, why they didn't just leave the pristine waterfront alone.)

Nicklaus and co-developer Marine Drive Properties recognize that green sells.

We share their confidence that the golfside residential lots, expected to start in the half-a-million dollar range, will sell out, and probably quickly.

For there is no overestimating the green demand side.

Fully two-thirds of Canadian consumers would switch their spending to companies that have demonstrated a commitment to green policies according to a survey done last month by Environics Research Group.

The poll found that 67 per cent said they are likely to switch to green businesses.

In British Columbia and Alberta, consumers are most likely to make the switch, with 83 per cent saying they would, even it meant paying a higher price.

"We're seeing a fundamental shift in consumer behavior that reflects the increased mainstreaming of environmental consciousness," says Michael Adams, founding president of Environics. "Canadians are very deliberately rewarding those companies who are taking action on the environment."

The flip side message: consumers will punish those who don't make environmental improvements.

So as a real estate investor, what does this mean to you?

As with any investment opportunity, there are many in the green area. When we can do our homework and find bargains and growth opportunities before the general market recognizes them, it is always a good thing.

First of all, buy into green buildings.

The ones built to green standards are usually built better and tend to retain tenants longer and command higher rents.

Buy into green condominium projects because they attract the kind of upscale, higher-income consumers you want to be associated with.

Ditto for commercial buildings.

Studies, such as Green Building Costs and the Financial Benefits (done for the Massachusetts Institute of Technology in 2003) show that while incorporating basic green features to a building can add less than one per cent to the overall cost, tenants are willing to pay higher lease rates, tend to stay in place longer, and the owners enjoy lower maintenance and energy costs.

"It used to be risky to go green," says Gregory Kats, managing principal of Capital E Group and former director of financing for energy efficiency and renewable energy at the U.S. Department of Energy.

"Now, it's clear, it's more risky to design inefficient and unhealthy buildings. It's bad management and bad investment strategy to not build green buildings."

Mark Palmer, San Francisco's green building co-ordinator, notes: "In a study of 33 buildings nationally (in the U.S,) the average added cost for building green was less than two per cent and the return was 10 times the investment over a 20-year period."

We would also advise investors to still look at waterfront real estate.

We know, we have seen the scary headlines and seen the Al Gore clip of New York and Florida disappearing beneath the waves.

Yet, according to the best and latest information and projections from the Intergovernmental Panel on Climate Change, worldwide sea levels may rise about 41 centimetres (16 inches) in 100 years.

If your oceanfront property is a yard above the water, you should be OK. Of course, lakefront would likely not be affected at all.

Buy farmland on the prairies. In Idaho and Iowa -- major producers of crops used for ethanol production, considered a greener fuel additive, farmland values have shot up as much as 20 per cent in the past year to $5,000 US per acre.

In Saskatchewan, where three ethanol plants are operating and a big one is about to open near the U.S. border at Belle Plaine, croplands average $350 per acre.

ROSSMOOR – These days, it's not uncommon to flip a house – buy a property, renovate it and quickly sell it – but Drew and Carolyn Wesling have come up with their own niche in this business, one that's friendlier to the environment.

The Seal Beach couple are going into business making older homes "green," hoping an environmentally conscious approach to homebuilding will translate into profit. Their first property, a $1.75 million Rossmoor home they bought two years ago for $800,000, is now on the market.

"These are just little things that can be done to help the environment," Drew Wesling, 35, a construction project manager and an accredited green professional. "This isn't cutting-edge stuff. It certainly didn't take any extra money."

The 3,500-square-foot home, which doesn't look all that different from any other house, includes energy-efficient windows, a "tankless" water heater, bamboo wood floors and a variety of environmentally friendly building materials.

When the Weslings bought the home in November 2005, it was a 1950s-style original Rossmoor tract home with three bedrooms. They gutted much of the one-story house and added a second story, two bedrooms, a family room and a breakfast nook, more than doubling its size.

Their "green" remodel is part of a nationwide trend toward adding more environmentally conscious features to homes, schools, libraries and commercial buildings, experts say.

Within a few years, building green could become as well-known as the Energy Star ratings on appliances like refrigerators, said Walker Wells, program director for Global Green, a Santa Monica-based nonprofit that promotes green building.

"If they can demonstrate to other builders that going green is a way to make money, that's phenomenal because hopefully other people will embrace it, too," Wells said.

The couple, however, aren't applying to have their home certified green by the U.S. Green Building Council. The guidelines are too strict, and certification would be too costly for a single house, they said.

Q. How did you get interested in building environmentally friendly houses?

Drew: I was exposed to green building in 2001 on a project in Santa Monica. It was an office building for the Natural Resources Defense Council, an environmental advocacy group. I loved that project, so I got involved in the U.S. Green Building Council and joined the board in Los Angeles.

Q. Your house looks brand new, but you actually renovated the original house. Why did you remodel instead of leveling it?

Drew: It's so much to easier to tear down the house, but you don't want to send all of that waste to the landfill.

Q. Do you live in a green house now?

Carolyn: No, we're renting in Seal Beach. We're looking for two lots in Rossmoor, one for us and one to sell. As soon as we're in escrow with this house, we'll move forward. I'm hoping as we move forward, they're going to get greener.

Q. You've had to move around a lot. You spent a year in your Rossmoor home, then decided to remodel it. When you build your next home, you'll have to move again. How do you cope?

Carolyn: We have a high tolerance for construction. I definitely feel like I've gone back to work, but I have control over what I'm doing, and the second income will be so nice.

Q. How did you convince your kids to let you sell the Rossmoor house?

Drew:They love the h

It is the middle class which suffered most from the OPEC-related gas price crisis of 1973. At that time, inflation and the price of oil were inextricably linked, and the middle class was hit with a period of high unemployment and high inflation. The 1990's period of previously unheard-of low unemployment and inflation was probably linked to $10/barrel oil, as much as the technology bubble.

The upper class loves expensive oil, with oil companies taking in huge profits. And as we've seen today, the stock exchange can do very well with $70/barrel crude. It's the middle class which suffers at the pump, and the middle class that's hurt by unemployment. It's also the middle class which would most benefit from efficienct cars and homes. That's why I think gov't policy should be centered on home improvements below $10k. And it's why I think energy policy belongs uniquely on the Democratic platform, is something to be capitalize on.

Incidentally, the 1973 crisis was linked to the 1971 removal of the gold standard: with dollars no longer anchored to $35/ounce of gold, a floating dollar was set for problems. Incredibly, OPEC decided to accept only American dollars as payment--a policy which continues today---meaning that instead of the Sterling's power based on the stock of gold England held through its empire, the American dollar became the standard world currency on the back of Middle East oil. The American dollar is backed not by gold but by Saudi oil. That's why there's a connection between inflation and the price of gas. And it's why we cannot allow anti-American monarchies to thrive there.

And this leads me to my second extrapolation:

The capital investment required to make America independant from OPEC oil (I'll assume we're still happy to take the 135 billion barrels of bitumen stuck in Canadian oil sands---Canada is the largest foreign exporter of oil to the US, it's just that the Saudis have the largest *reserve* stock, they're the only ones who can turn up the taps, so they control world prices) the captial required is only available through a massive government-sponsored, R&D led investment. Something over a trillion dollars in a twenty-year period.

And the only reason the government will MAKE that investment is if it becomes clear to them that our national security is, today, more tied up in energy than in bombs. I think the example of Russia is instructive here, and the clarity with which Putin sees his reserves in the Caspian as more important to Russia's place in world politics today than its ability to blow up the planet.

I remember a talk I had at a lunch table at Los Alamos. It was my claim that energy was a larger national security issue than nukes, and that we needed a Los Alamos project targeted at new technologies to reduce our reliance on foreign oil.

Today I believe something a little different:

Los Alamos was founded in the 30s and we had a world-changing (and war-ending) new technology 15 years later. No such technology exists to solve the energy problem. What is instead required is a massive investment in infrastructure and existing (but immature) technologies which haven't been developed by the private sector in the years following the 1973 crisis. We require stricter building codes and higher CAFE standards.

And the frame for this debate cannot be global warming.

Incidentally, ever wonder why global warming gets more press in the UK? It's because the growth of the UK economy is unlinked to a growth in oil consumption. To grow our own GDP we *require* more oil, although this link has become weaker in the post-industrializing period since the 1970s. The GDP/oil growth ratio in China and India is the same as it was in the US from 1940-70, reflecting their rapid industrialization.

Global warming isn't going to cut any ice in the US, not on the trillion-dollar levels required. But energy security can. If another price shock occurs (e.g. a supertanker blown up, moves from the Caspian toward China, etc.) , up to $5 or so, it may be possible to convince the government to make investments on a par with the US Military.

So strategy one is hippy houses ('enabled' houses maybe). Strategy two is a new energy complex. And overriding is a political strategy of putting enviornmentalism (NEW enviornmentalism, attached to warming and security as opposed to the land-use issues of the past) to the fore of the Democratic party.

Flipping Green Houses

And that's assuming hydrogen is up to 10% of transport energy by 2030--far from assured. It also assumes electric hybrids are adopted far more than today.

The point is, efficiency in the home is just as important to carbon savings as efficiency at the pump. The methods are cheaper and more DIY, and are amortized in a home which will stand for >20 years (the average life of a car in the US is 7 years). Here's how the improvements break down:

The IEA projects a large amount of savings through insulation and heat pumps. They claim that 37% of energy used in a home is for heating, and that proper insulation and the use of heat pumps can reduce this by 75%. Their projected cost for such improvements over 20 years is 1-2 cents per kWh saved.

The heat pump comes with a $500 or 10% federal tax incentive and $200 from energySTAR incentives in Oregon. The same incentive project gives roughly $0.30/sq foot back for improved insulation. These lower the capital cost to $3500-550=$2950 for the heat pump and $2000-1500 =$500 for the insulation. Orgeon's credit for insulation is absolutely insane: they pay around 80% of the materials cost. Everybody should be doing it.

At a $20 mortgage value increase per dollar energy saved these improvements are worth (in principle) around $9000.

19% of the energy used in a home is for lighting. Here they suggest the obvious, which is higher-efficiency bulbs.

For both of the above the IEA also discusses the possibility of central computer control of lighting, heating, security, and safety (i.e. fire detectors et al.). The only method of controlling heat today is the thermostat, but as I flip through catalogues I reckon I could put one together for the low thousands---essentially a PDA programmed to talk to USB-enabled power outlets (also here) and web-enabled thermostat connected to room temperature detectors and enabled air vents.

The PDA (probably running the open Symbian OS) would give you independant control of each room's temperature, together with lighting. In the process of a retrofit one could easily make a home 'enabled' by running USB and hi-def video output thru the walls to a central computer (e.g. a media center with a very large hard drive for DVD storage). Any room of the house could hook up to the television/movies/internet just by plugging a keyboard and tv into the wall. The central computer would also track smoke alarms that never run out of batteries (and perhaps a security system?)

The web-enabled thermostat runs you $200 and hdmi/usb enabled wall plates run around $50 each. Cable installation would presumably take place during the larger retrofit and might run in the low hundreds. A new computer (no monitor) would run around $1500. I feel like this would be a large value-adding geegaw that might be worth $6000 to the prospective buyer. Could pop in speakers to the rooms as well.

8% of future improvements in home efficiency will come from newer appliances (i.e. other than air conditioners). In most cases, though, the cost savings in a new appliance does not excuse replacing the old one. There are small incentives in Oregon for new dishwasers, fridges, or washing machines of around $80-$200.

Finally there is solar water heating, which is very much DIY. Active solar air heating is still about 3-5 times more expensive than traditional heat/air and won't be commercial for decades. A DIY flat-plate water heater runs around $700 before $200 in incentives and pays back immediately.

So here's the picture:

Year one, I live as cheaply as possible, in Oregon, working both as a teacher and as a renewable energy salesman.Year two, I buy a home with a mid-term mortgage. I dump around $8k into home improvements, including (but not limited to) efficiency improvements.Year three, I sell the home and move on with pocketed money and experience.

The home improvements start with better insulation and windows, together with a new heat pump. Together these run $5500, $2500 of which is paid back to me. The improvements should add $8000 in value to the house.

They continue with a solar water heater, which will cost $700, $150 of which will be paid back. It adds $1000 to the value of the house.

Next in line is computer control, of my own design. This aspect may have its own commercial application. The cost is $2500 and I estimate its worth is at least $5000.

Finally I install efficient lighting and appliances. Also, stuff which may be of value: a deck, or flooring, or a new kitchen. An 'arizona' room adds sq ft to a house which generally exceeds the required investment. These soak up the remainder of my $10k investment.

I then hope to sell the house for (at least) $20k more than I bought it for.

Renewable Hydrogen?

One kilo of hydrogen gas is energetically equivalent to one gallon of gasoline. Granted, a fuel cell or internal combustion engine running hydrogen is a little more efficient than gas, but the energy lost from storing the hydrogen (as a liquid, or in a metal hydride--see next post) more than makes up for this. Anyway 1 kg H_2/gallon gas is convenient.

The hydrolysis process to produce that kg of hydrogen requires about 65 kWh of electricity (practically) though this could be lowered to 40 kWh in the mid-term future. Everything involving hydrogen or renewables takes a 20-year window or so.

In 2005 the US consumed 140 billion gallons of gas. So to replace gasoline with hydrogen would require 8,000 terawatt-hours of electricity, roughly one-and-a-half times the throughput of the current electrical system. Doing so without carbons would require the construction of something like 1000 nuclear power plants.

The US is currently planning three new plants and they're being fought like hell.

The present price of electricity in the US averages (in 2004) about 7 cents per kWh commercially, 5 cents industrially. At these prices a kg of h_2 would cost around $5: perhaps lower if the utility itself got involved in the hydrogen business.

Let's set our sights on electrolysis via solar energy provided by stirling engines. According to Sterling Energy Systems (SES), their 150 kW units currently cost $150,000, 25% of which cost is the solar dish. So the engine itself, provided by a german company who manufactures them for use in ultra-silent submarines, costs over $100k. SES claims that they can reduce the cost, once mass-production is set up, to $50k a unit.

We'll put our generators in the Mojave desert, as SES has, where an average of 6000 Watt-hours per day is produced, implying around 7 hours per day (on average) that the engines will run. So the cost per kWh (using the optimistic engine cost of $50k) over 5 years is a shade over 3 cents, implying a hydrogen cost of $3.50/kg.

Over 10 years, and let's include the cost of keeping the engines running etc, this goes down to maybe $2.50. Are industries willing to sink huge capital into projects that will only turn a profit after ten years (if then)? I dunno.

Here is the breakdown of the cost of a gallon of gas in 2007:

Distribution

Costs, Marketing Costs and Profits $0.20

Crude Oil Cost $1.72

Refinery Cost and Profits $0.63

State Underground Storage Tank Fee $0.01

State and Local Sales Tax $0.23

State Excise Tax $0.18

Federal Excise Tax $0.18

Retail prices $3.16

So we're competing with the crude + refinement cost of $2.30. Even in the best case renewable hydrolysis only competes with $5/gallon oil, or $100 a barrel sweet crude. I don't see that happening anytime in the next 50 years (It's at $73 now).

So far the scheme appears to be possible if unlikely. But now look that the investment required:

Let's take our goal as producing 10% of the 8,000 TWh renewably, and have a look at the SES plant in Mojave:

Seller

Gen. Type

Initial Size (MW)

Possible Expansion Size (MW)

Estimated Annual Energy Based on Initial Size (GWH)

Estimated Annual Energy Based on Expansion Size (GWH)

Initial Phase On-Line Date

Completion Date for Initial Size

Term of Agreement (Years)

Estimated Capacity Factor

SES Solar One LLC

Solar Thermal ( Stirling Dish)

500

850

1,047

1,780

Jan. 2009

Dec. 2012

20

23.90 percent

This plant is composed of some 3,000 individual generators and is projected to go online in 2009. Using SES's numbers (the big one, $150k/generator) I'd guess it'll cost about half a billion dollars.

For 800 TWh you'd need around 1000 such plants at a cost of half a trillion dollars, just to provide the power. Best case, to provide 10% of America's gasoline requirements renewably you'd need around a trillion dollars. That's maybe not excessive in light of the e.g. 70 billion being invested to extract canada's oil sands, but then that's coming from big oil. Who's investing in hydrogen?

All my numbers here have been incredibly idealized, using stirling power as a magic bullet--far superior to photovoltaics--and remember they only seek to supplement transportation by 10%. Conclusion? Gasoline can't be replaced renewably at anything like our current usage levels. And remember that if you're making hydrogen from something other than nuclear power, you're just replacing the delivery system: oil still needs to go into producing electricity (or perhaps coal, but this is dirty, or natural gas, but the US hasn't invested heavily in that).

Extrapolation? Renewables need to be targeted to middle-class families feeling the pinch of increased energy prices. This area (<$10k) takes maximum advantage of government aid and capitalizes on public opinion. But it can't help in the long haul.

A New Cold War

As far as I can tell, there is no book that addresses what technological issues need to be addressed. I mean, suppose the US starts a new 'apollo' project with greentech as its research goal. What technologies, exactly, would such an institution study?

Energy: the new cold war

Liam Fox

Since the close of the cold war, we have been growing used to threats such as terrorism where the enemy has no state or territory. But soon we will have to get used to new strategic challenges, such as energy security, where fossil fuels will be used as weapons to achieve political ends. Energy security will be synonymous with national security and economic security.

Two weeks ago Russia announced its intention to annex a 460,000-square mile portion of ice-covered Arctic. Scientists claim that the area, on which Russia has audaciously set its sights, may contain an estimated 10 billion tonnes of gas and oil deposits. While this ridiculous claim has no legitimate legal basis, the West must take threats like this from Russia seriously.

Russia is rivalling Saudi Arabia as the world’s largest oil producer and is estimated to have the world’s largest natural gas supplies with 1,680 trillion cubic feet - nearly twice the reserves in the next largest country, Iran. If military might and nuclear weapons formed the core of Soviet cold war power, Russian elites view its energy resources as the basis of its power now.

Russia has demonstrated that it will use its energy resources to promote a broader foreign policy agenda. This was illustrated when Russia reduced gas supplies to the Ukraine as part of a bilateral dispute and when it doubled the price of gas to Georgia in 2005.

Russia’s petrodollars are financing a $189 billion overhaul of its armed forces between now and 2015. They will purchase more than 1,000 new aircraft and helicopters, 4,000 new tanks and armoured vehicles and a new submarine fleet. New missiles will carry nuclear warheads. Western addiction to oil and gas is causing us to fund the threat against us.

Reports that Russia is now withdrawing from the Conventional Forces in Europe Treaty will only fuel suspicions about Putin’s defence posture.

The stand-off over Litvinenko is another source of tension.

Unfortunately, the threats do not stop with Russia. Terrorism poses a major threat to world energy supplies, transport and infrastructure especially. Osama Bin Laden has described refineries as the “hinges” of the world’s economy. Al-Qaeda’s failed attack last year on the Abqaiq oil facility in Saudi Arabia is a reminder of the threat.

Future attacks could disrupt the world economy far more. An assault on a super-tanker in the Straits of Malacca could send the oil price rocketing, and tip economies which have just about coped with higher oil prices over the edge. If Japan’s maritime supplies of crude oil were choked, even temporarily, a crisis of confidence could reverberate around the world. For developing countries, a sudden rise in fuel prices could wipe out the benefits of aid or debt relief. Fuel poverty would be a brutal reality.

Fear of terrorism is justified. In 2002, Al-Qaeda terrorists rammed a boat rigged with explosives into a French tanker off Yemen but fortunately it did not sink.

The distribution of global energy supplies means we are particularly vulnerable to the “choke points” in transport routes around the globe. These are far more numerous than the days when we simply patrolled the Strait of Hormuz. They are scattered from the Panama Canal to the entrance to the Red Sea to the seas of southeast Asia. So what can be done to ensure the security of energy resources, including the refining and transport of such resources?